Shareholder Returns Policy and Dividend Information

Dividend policy (Period covered: up to the fiscal year ending March 31, 2029)

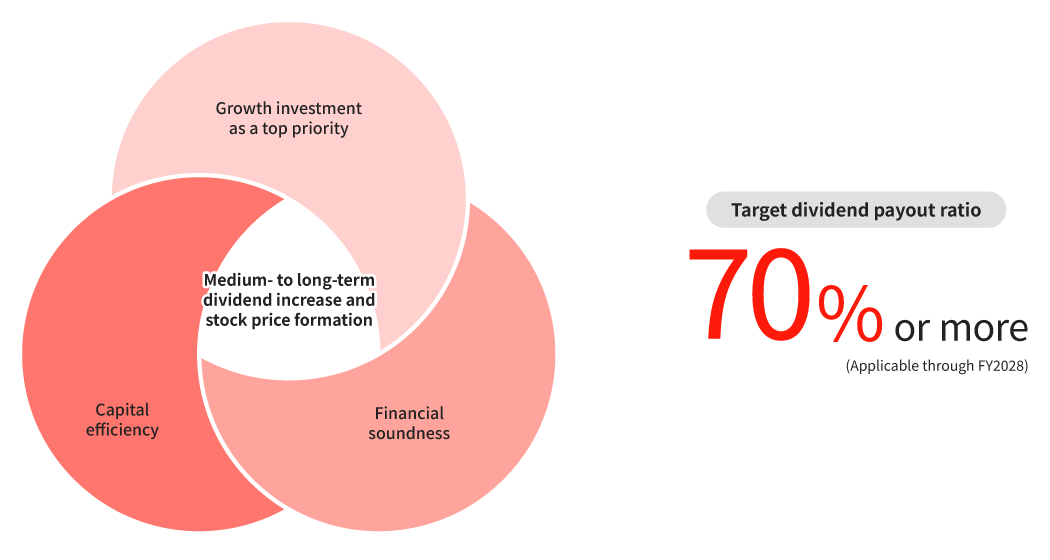

We prioritize strategic investment for sustainable growth and aim to maximize corporate value. At the same time, we also aim to increase capital efficiency with an awareness of cost of capital, leading to increased dividends over the medium and long term and reflection in share prices, so we have set a target of 70% or higher for the consolidated dividend payout ratio.

(Announced January 31, 2024)

Cash dividends

Earnings per share

(Yen)

Dividend per share

Total amount of dividends

(Millions of yen)

Payout ratio

(%)

Total payout ratio

(%)

| 2022/03 | 2023/03 | 2024/03 | 2025/03 | 2026/03 | |

| Year-end | 69.7 | 28.1 | 191.8 | 129.6 | – |

Total payout ratio = (dividend amount + total amount of treasury share repurchases) ÷ net income attributable to owners of the parent × 100

Total amount of treasury share repurchases

This table can be scrolled

| Repurchases period | Total number repurchased (Shares) |

Total repurchase amount (Yen) |

|---|---|---|

| August 1 – October 20, 2023 | 500,000 | 571,799,500 |

| August 1 – October 20, 2021 | 358,900 | 799,817,900 |

| February 1 – March 17, 2017 | 411,400 | 299,957,800 |

| December 1 – December 17, 2008 | 1,000 | 43,500,250 |

Stock splits

This table can be scrolled

| Effective date | Split ratio | Increase in number of shares due to split (Shares) |

|---|---|---|

| December 1, 2015 | 1:3 | 13,154,000 |

| October 1, 2010 | 1:100 | 6,299,370 |

| October 1, 2007 | 1:2 | 31,203 |

Shareholder benefits

There is currently no shareholder benefit scheme in place.