General Stock Information

Stock overview

| Stock code | 2148 |

|---|---|

| Listing | TSE Prime Market |

| Total number of issued shares | 21,061,000 shares (As of March 31, 2025) |

| Number of shares constituting one trading unit | 100 shares |

| Business year | April 1 to March 31 of the next year |

| General Meetings of the Shareholders | Every year in June |

| Record date | Every year on March 31 |

| Reporting method | Electronic public notice (in Japanese). However, in the event that electronic public notices cannot be provided due to accidents or other unavoidable circumstances, public notice shall be given in the Nihon Keizai Shimbun. |

| Shareholder benefits | There is currently no shareholder benefit scheme in place. |

Stock Ownership

Major shareholders

(As of March 31, 2025)

This table can be scrolled

| Shareholder | Number of shares held (Shares) | Shareholding (%) |

|---|---|---|

| SB Media Holdings Corp. | 10,457,400 | 53.4 |

| The Master Trust Bank of Japan, Ltd. (Trust Account) | 932,000 | 4.8 |

| Junichi Niino | 367,500 | 1.9 |

| Toshiki Otsuki | 273,900 | 1.4 |

| Custody Bank of Japan, Ltd. (Trust E Account) | 187,026 | 1.0 |

| MSIP CLIENT SECURITIES | 182,900 | 0.9 |

| Custody Bank of Japan, Ltd. (Trust Account) | 149,700 | 0.8 |

| Takashi Kobayashi | 148,900 | 0.8 |

| ITmedia Inc. Employee stock ownership plan | 117,000 | 0.6 |

| Kenji Kimura | 110,000 | 0.6 |

(Note) The Company holds 1,460,002 treasury shares which are excluded from the table above. In addition, the shareholding ratio is calculated after deducting treasury shares.

Additionally, this number of treasury shares does not include the Company’s shares (187,026 shares) held by Custody Bank of Japan, Ltd. (Trust E Account) based on the Company’s Board Benefit Trust Scheme.

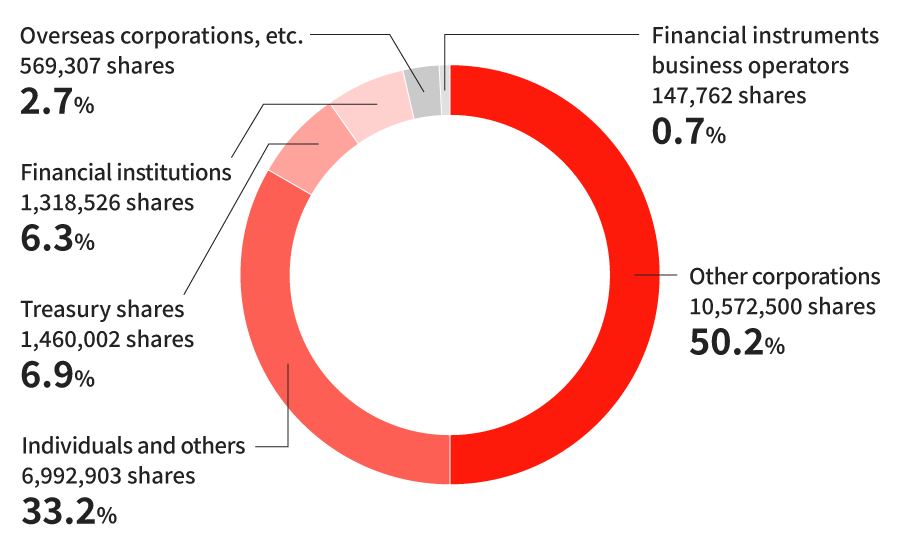

Breakdown by type of shareholder

(As of March 31, 2025)